Bullish Reversals

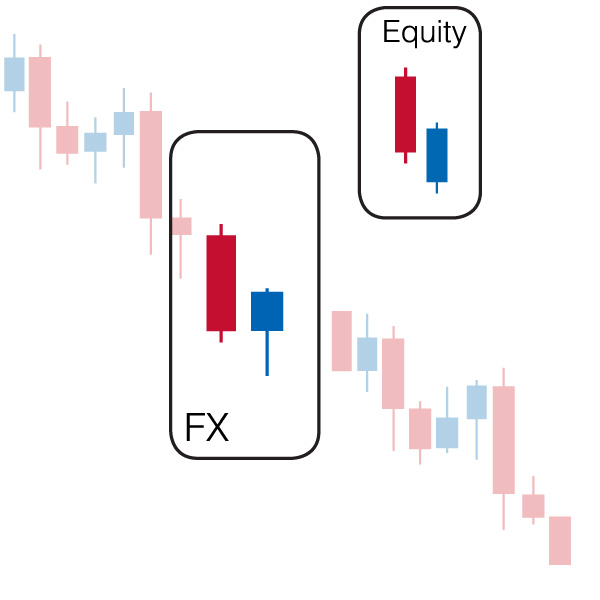

Bullish Continuation

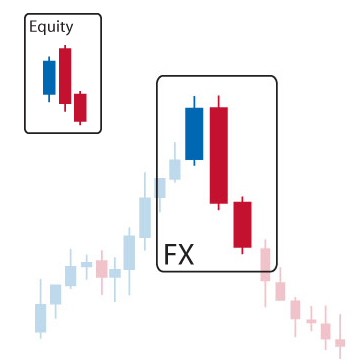

Bearish Reversals

Bearish Continuation

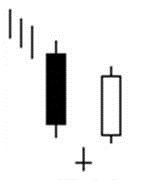

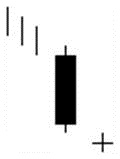

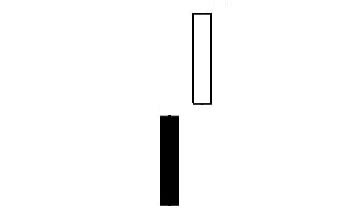

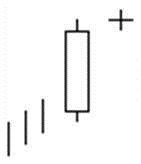

Abandoned baby

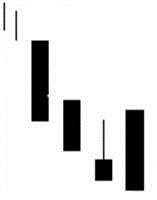

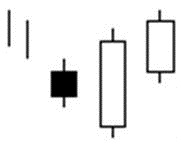

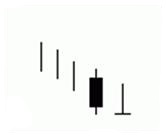

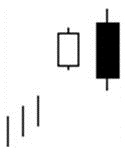

Concealing Baby Swallow

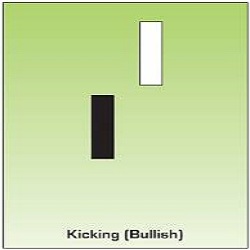

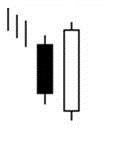

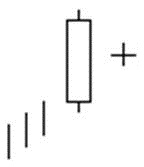

Kicking

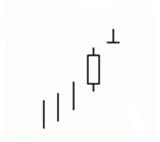

Morning Doji Star

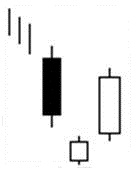

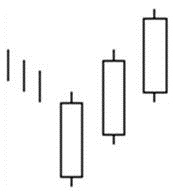

Morning star

Piercing Line

3 Inside-Up Pattern

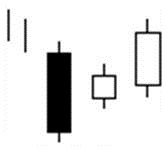

3 Outside-Up

3 White Soldiers

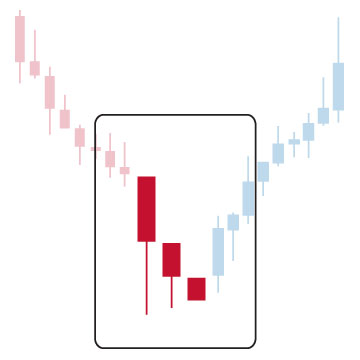

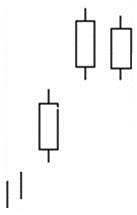

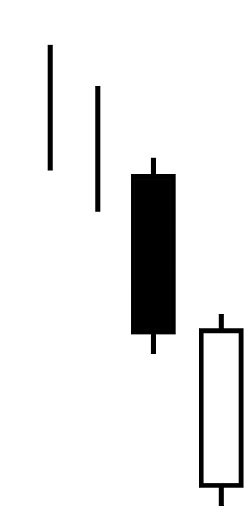

- Market is characterised by downtrend.

- We usually see a long black candlestick in the first day.

- Then a Doji appears on the second day whose shadows gap below the previous day's lower shadow and gaps in the direction of the previous downtrend.

- Then we see a white candlestick on the third day with a gap in the opposite direction with no overlapping shadows.

Bullish Abandoned Baby:

The Bullish Abandoned Baby pattern is a very rare bottom reversal signal that is similar to

the Morning Star pattern and almost the same as the Morning Doji Star.

The difference is that the shadows on the Doji must gap below the shadows of the first

and third days for the Abandoned Baby bottom.

We have a similar scenario that is valid for most of the three-day star patterns. In a falling market,

the market shows bearish strength first with a long black candlestick and opens with a gap on the second day.

The second day trading is within a small range and second day closes at or very near its open.

This now suggests the potential for a rally showing that positions are changed.

The signal of trend reversal is given by the white third day and by well-defined upward gap.

- The Bullish Abandoned Baby pattern is quite rare.

- The reliability of this pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

- Market is characterized by a downtrend.

- We see two consecutive Black Marubozu on the first and second days.

- Then we see a black candlestick on the third day opening with a downward gap but trading into the body of the second day and it is characterized by a long upper shadow.

- Finally we see another Black Marubozu on the fourth day that completely engulfs the candlestick of the third day including the shadow.

Concealing Baby Swallow pattern: The Bullish Concealing Baby Swallow pattern consists of four candlesticks, which is highlighted by two consecutive Black Marubozu. They are characterized by the fact that a gapping black candlestick trades into the body of the previous day and it is seen during a downtrend. Then there is another Black Marubozu on the third day showing selling of positions since it closes at a new low. However, this may give incentive to the shorts to cover their positions implying that a bullish reversal is now possible.

Explanation: Two black Marubozu show that downtrend is continuing to the satisfaction of the bears or shorts. On the third day, we see a downward gap further confirming the downtrend. However, prices on the third day start going above the close of the previous day causing some doubts about the bearish direction even though the day closes at or near its low. The next day shows us a significantly higher gap in the opening. After the opening, however, prices again go down closing at a new low. This last day may be interpreted as a good chance for the short-sellers to cover their short positions. Strong short covering should propel the price upward in the coming days.

Important factors:- The reliability of this pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

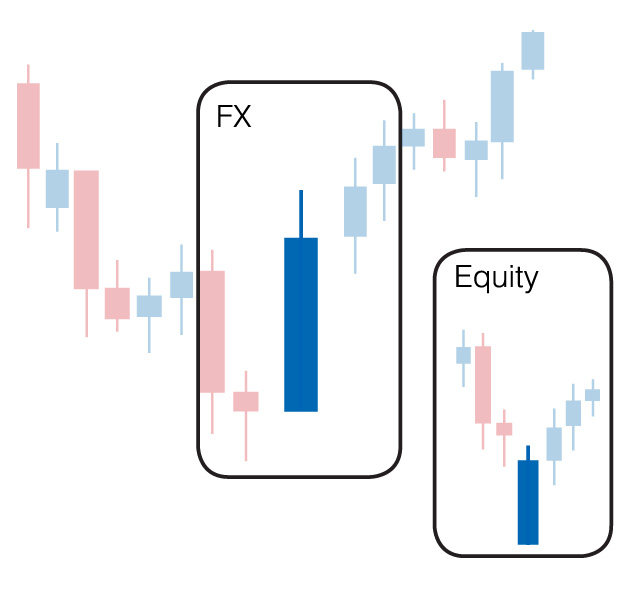

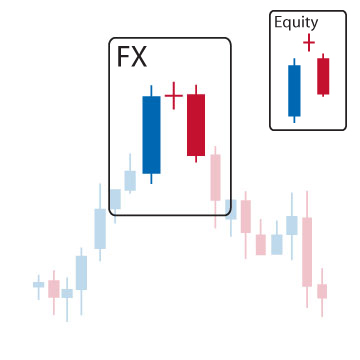

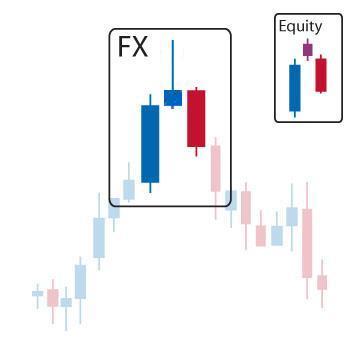

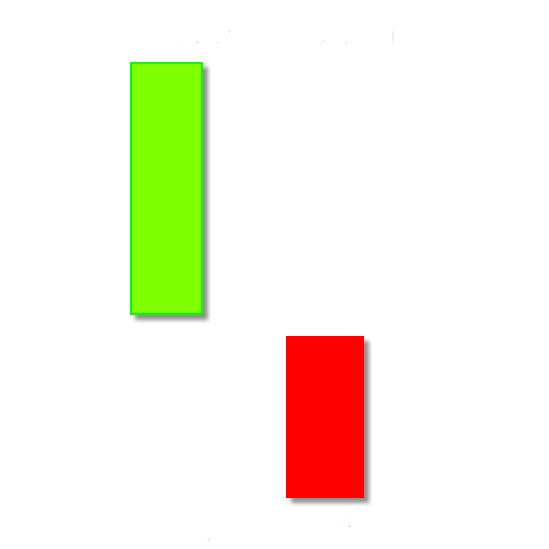

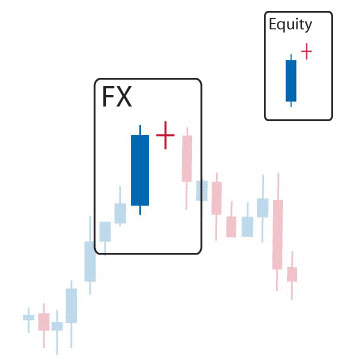

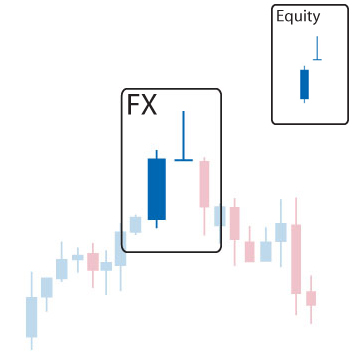

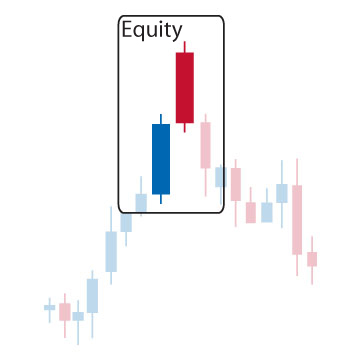

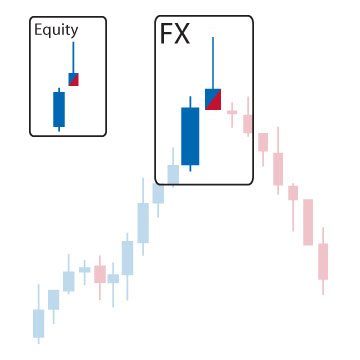

- Market direction is not important.

- We first see a Black Marubozu pattern.

- Then we see a White Marubozu that gaps upward on the second day.

Bullish Kicking: The Bullish Kicking pattern is a Black Marubozu followed by a White Marubozu. After the Black Marubozu, the market gaps sharply higher on the opening and it opens with a gap above the prior sessions opening thus forming a White Marubozu.

Explanation: This Bullish Kicking Pattern is a strong sign showing that the market is headed upward. The previous market direction is not important for this pattern unlike most other candle patterns. The market is headed up with the Bullish Kicking Pattern as the prices gap up the next day. The prices never enter into the previous day's range. Instead they close with another gap. The gap created by the second day becomes a support area. Expect higher prices and for the gap to be tested before breaking back to the downside.

Important factors:- We should be careful that both of the patterns do not have any shadows or they have only very small shadows (they both are Marubozu).

- The Bullish Kicking Pattern is somewhat similar to the Bullish Separating Lines Pattern.

- The opening prices are equal in Bullish Separating Lines Pattern, while in the Bullish Kicking Pattern a gap occurs.

- The Bullish Kicking Pattern is highly reliable, but still, a confirmation of the reversal on the third day should be sought. This confirmation may be in the form of a white candlestick, a large gap up or a higher close on the third day.

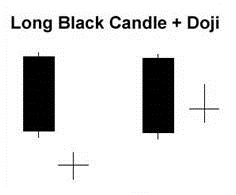

- Market is characterised by downtrend.

- We see a long black candlestick in the first day.

- Then we see a Doji on the second day that gaps in the direction of the previous downtrend.

- The white candlestick on the third day confirms the reversal.

Morning Doji Star: A Morning Doji Star is also a three-candlestick formation signaling a major bottom reversal. It is composed of a long black candlestick followed by a Doji, which characteristically gaps down to form a Doji star. Then we have a third white candlestick whose closing is well into the first session’s black real body. If the candlestick after the Doji star is black and gapped lower, the bullishness of the Doji is invalidated. It is more significant than the regular Morning Star pattern and is a meaningful bottom pattern.

Explanation: The black real body while the market is falling down may suggest that the bears are in command. Then a Doji appears showing the diminishing capacity of sellers to drive the market lower. Confirmation of bull ascendancy is the third day’s strong white real body. An ideal Bullish Morning Doji Star Pattern must have a gap before and after the middle line’s real body. The second gap is rare, but lack of it does not take away from the power of this formation.

Important factors:- The Doji may be more than one, two or even three.

- Doji gaps are not important.

- The reliability of the Morning Doji Star pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

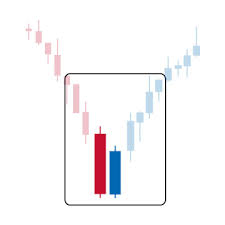

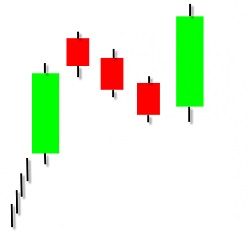

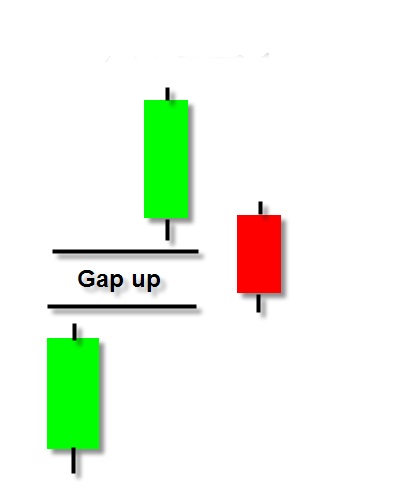

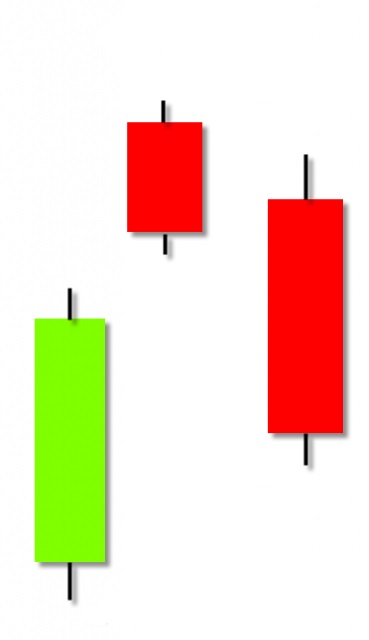

- Market is characterized by downtrend.

- A long black candlestick in the first day.

- Then a small body on the second day gapping in the direction of the previous downtrend.

- Finally we see a white candlestick on the third day.

Morning Star: Morning Star is a bullish bottom reversal pattern. The formation is comprised of three candlesticks. The first candlestick is a long black real body followed by the second, a small real body, which gaps (opens) lower (a star pattern). The third candlestick is a white real body that moves well into the first period's black real body. The third candle is the confirmation of the reversal and shows that the market has turned bullish now. It is named “Morning Star” because it appears in the morning before the sun rises. This is similar to an island pattern on standard bar charts.

Explanation: We see the black body in a falling market suggesting that the bears are in command. Then a small real body appears implying the incapacity of sellers to drive the market lower. The strong white body of the third day proves that bulls have taken over. An ideal Bullish Morning Star Pattern preferably has a gap before and after the middle candlestick. The second gap is rare, but lack of it does not take away from the power of this formation.

Important factors:- The stars may be more than one, two or even three.

- The colour of the star and its gaps are not important.

- The reliability of this pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

Piercing Line: The Bullish Piercing Line is a bottom reversal pattern, consisting of two day’s candlesticks. It is composed of a long black body followed by a gap lower during the next day, while the market is in downtrend. The day ends up as a strong white candlestick, which closes more than halfway into the prior black candlestick’s real body. It tells that the market opens lower on the opening and closes above the midpoint of the prior body. The Piercing Line is the opposite of the dark-cloud cover pattern.

Explanation: The market moves down in a downtrend. The first black real body reinforces this view. The next day the market opens lower via a gap. Everything now goes, as bears want it. However, suddenly the market surges toward the close, leading the prices to close sharply above the previous day close. Now the bears are losing their confidence and reevaluating their short positions. The potential buyers start thinking that new lows may not hold and perhaps it is time to take long positions.

Important factors:- In the Bullish Piercing Line pattern, the greater the degree of penetration into the black real body, the more likely it will be a bottom reversal. An ideal piercing pattern will have a real white body that pushes more than half way into the prior session’s black real body.

- In the Bullish Piercing Line pattern, the greater the degree of penetration into the black real body, the more likely it will be a bottom reversal. An ideal piercing pattern will have a real white body that pushes more than half way into the prior session’s black real body.

- A confirmation of the trend reversal by a white candlestick, a large gap up or by a higher close on the next trading day is suggested.

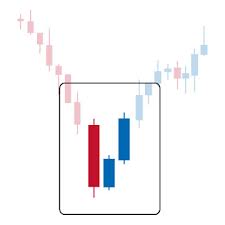

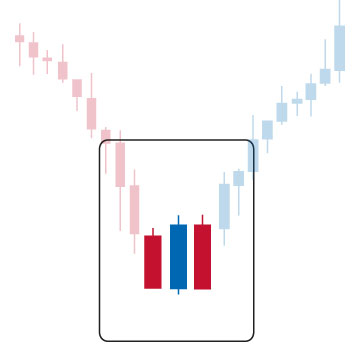

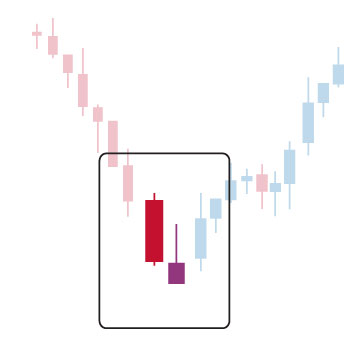

- Market is characterized by downtrend.

- We see a Bullish Harami Pattern in the first two days.

- Then we see a white candlestick on the third day with a higher close than the second day.

Three inside-up pattern: The Bullish Three Inside-Up Pattern is another name for the Confirmed Bullish Harami pattern. It consists of three days candlesticks with the third day being confirmation of the bullish trend reversal.

Explanation: The first two days of this pattern is simply the Bullish Harami Pattern, and the third day confirms the reversal suggested by the Bullish Harami Pattern, since it is a white candlestick closing with a new high for the last three days.

Important factors:- The reliability of the Bullish Three Inside-Up pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

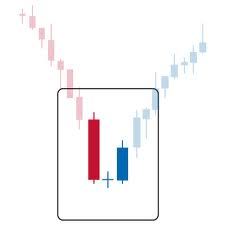

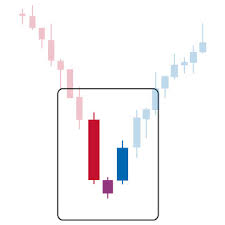

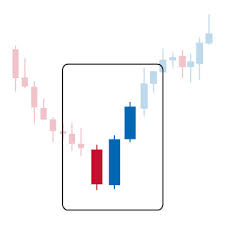

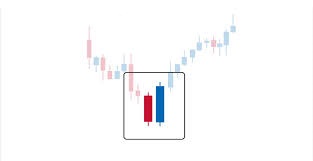

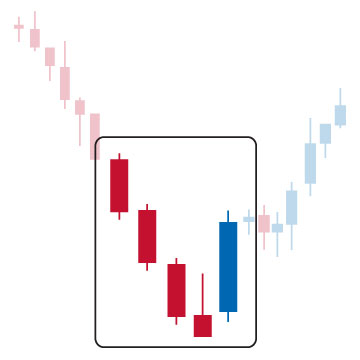

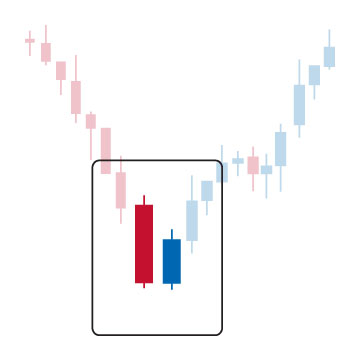

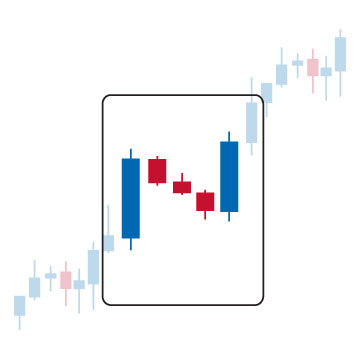

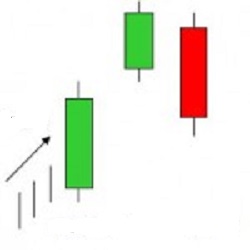

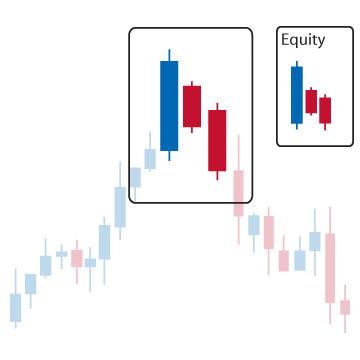

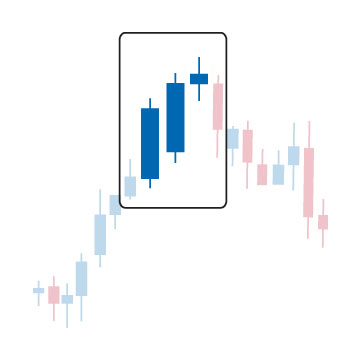

- Market is characterized by a downtrend.

- We see a Bullish Engulfing Pattern in the first two days.

- The third day is a white candlestick with a higher close than the second day.

Three Outside-up pattern: The Bullish Three Outside-Up Pattern is simply another name for the Confirmed Bullish Engulfing Pattern. Again it consists of three day’s candlesticks with the third day being confirmation of the bullish trend reversal.

Explanation: The first two days of this three-day pattern is simply a Bullish Engulfing Pattern, and the third day confirms the reversal suggested by the Bullish Engulfing Pattern since it is a white candlestick closing with a new high for the last three days.

Important factors:- The reliability of the Bullish Three Outside-Up pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

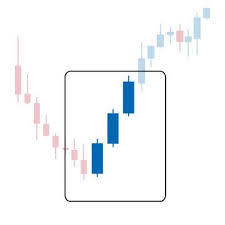

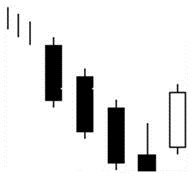

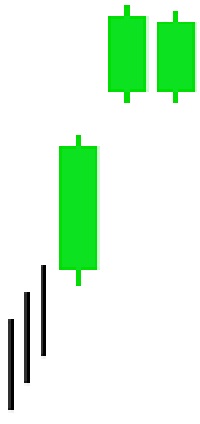

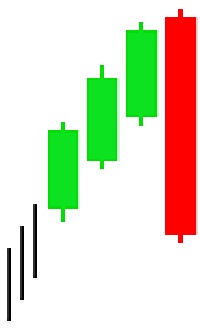

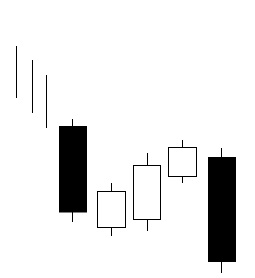

- Market is characterised by a downtrend.

- We see three consecutive long white candlesticks.

- Each candlestick closes at a new high.

- The opening of each candlestick is within the body of the previous day.

- Each consecutive day closes near or at its highs.

Three White Soldiers pattern: The Bullish Three White Soldiers pattern is indicative of a strong reversal in the market. It is characterised by three long candlesticks stepping upward like a staircase. The opening of each day is slightly lower than previous close rallying then to a short term high.

Important factors:- The opening prices of the second and third days can be anywhere within the previous day's body. However, it is better to see the opening prices above the middle of the previous day's body.

- If the white candlesticks are very extended, one should be cautious about an overbought market.

- The reliability of the Bullish Three White Soldiers pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

Doji general

Doji (01)

Doji (02)

Doji Star

Dragonfly Doji

Gravestone Doji

Long-Legged Doji

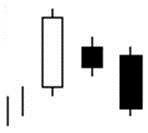

Breakaway

Engulfing pattern

Harami Cross

Homing Pigeon

Ladder Bottom

Matching Low

Meeting Lines

Stick Sandwich

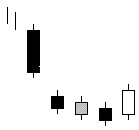

3 Stars in the South

Tri Star

Unique 3 River Bottom

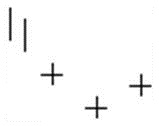

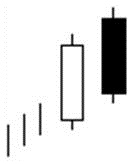

Doji general:

- Doji - Doji are important candlesticks that provide information on their own and as components of in a number of important patterns.

- The Doji should have a very small body that appears as a thin line.

- Doji candlesticks have the same open and close price or at least their bodies are extremely short.

- Doji suggest indecision between buyers and sellers. Prices move above and below the open price during the session, but close at or very near the open price. Neither buyers nor sellers were able to gain control and the result was essentially a draw.

- There are four special types of Doji lines. The length of the upper and lower shadows can vary and the resulting candlestick looks like a cross, inverted cross or plus sign. The word "Doji" refers to both the singular and plural form.

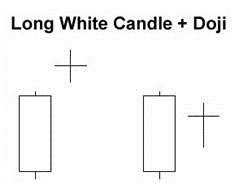

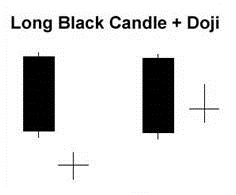

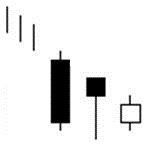

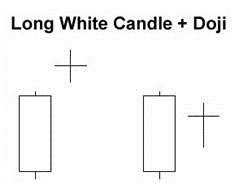

Doji and other Candlesticks:

When a Doji forms on your chart, pay special attention to the preceding candlesticks.

If a Doji forms after a series of candlesticks with long hollow bodies (like white Marubozus), the Doji signals that the buyers are becoming exhausted

and weakening. In order for the price to continue rising, more buyers are needed but there are not anymore! Sellers are licking their chops

and are looking to come in and drive the price back down.

Keep in mind that even after a Doji forms, this does not mean to automatically go short.

Confirmation is still needed. Wait for a bearish candlestick to close below the long white candlestick’s open. If a Doji forms after a series of candlesticks

with long filled bodies (like black Marubozus), the Doji signals that sellers are becoming exhausted and weakening.

In order for the price to continue falling, more sellers are needed but sellers are all tapped out! Buyers are foaming in the mouth for a chance to get in cheap.

While the decline is sputtering due to lack of new sellers, further buying strength is required to confirm any reversal.

Look for a white candlestick to close above the long black candlestick’s open.

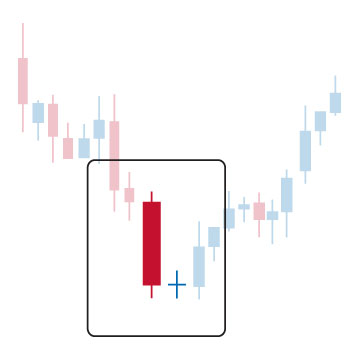

After a decline or long black candlestick, a Doji indicates that selling pressure may be diminishing and the downtrend could be nearing an end. Even though the bears

are starting to lose control of the decline, further strength is required to confirm any reversal. Bullish confirmation could come from a gap up, long white candlestick

or advance above the long black candlestick's open. After a long black candlestick and Doji, traders should be on the alert for a potential morning Doji star.

Doji and other Candlesticks:

Doji and other Candlesticks:

Idem (01)

- Market is characterised by a downtrend.

- We see a long black candlestick on the first day.

- Then we see a short candlestick, a spinning top, or a Doji, that gaps in the direction of the previous trend on the second day.

- The shadows of this short candlestick, spinning top, or Doji are not long.

Bullish Doji Star: The Bullish Doji Star pattern is a short candlestick, a spinning top, which gaps from a long black candlestick during a downtrend.

Explanation: The downtrend is in full force with a strong first day. All confidence built up by the bears from the first day is destroyed when the second day's gap down closes near it's open. Usually a star that follows a long black candlestick in a downtrend indicates a change in the market environment. Bears or shorts were in control during the downtrend but now a change is implied by the appearance of a star that shows that the bulls and the bears are in equilibrium. The downward energy is dissipating. Things are not favourable for a continuation of a bear market and short covering will quickly appear if the next day opens higher.

Important factors:- A confirmation of the reversal on the third day is required. This confirmation of the trend reversal may be in the form of a white candlestick, a large gap up or a higher close on the next trading day (third day).

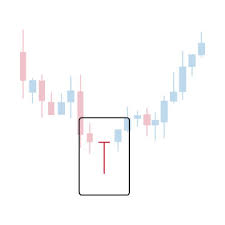

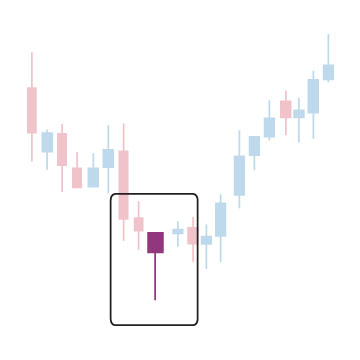

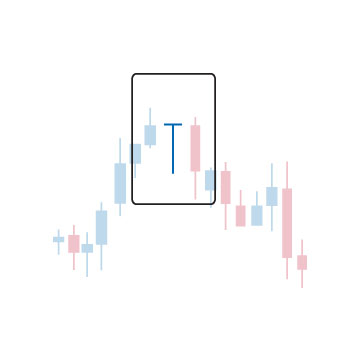

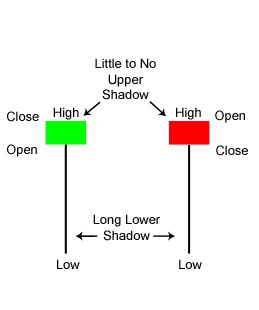

- There is an overall downtrend in the market.

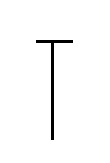

- Then we see a Doji at the upper end of the trading range.

- The Doji has an extremely long lower shadow.

- However the Doji does not have any upper shadow.

Bullish Dragonfly Doji: The Bullish Dragonfly Doji pattern is a single candlestick pattern that occurs at the bottom of a trend or during a downtrend. The Bullish Dragonfly Doji pattern is very similar to the Bullish Hammer Pattern. The distinction between the two is if there is a body or not. In case of Bullish Dragonfly Doji pattern, the opening and closing prices are identical and there is no body. On the other hand the Bullish Hammer Pattern has a small real body at the upper end of the trading range. The Dragonfly Doji forms when the open, high and close are equal and the low creates a long lower shadow. The resulting candlestick looks like a "T" with a long lower shadow and no upper shadow. The Dragonfly Doji pattern indicates that sellers dominated trading and drove prices lower during the session. By the end of the session, buyers resurfaced and pushed prices back to the opening level and the session high. The reversal implications of a dragonfly Doji depend on previous price action and future confirmation. The long lower shadow provides evidence of buying pressure, but the low indicates that plenty of sellers still loom. After a long downtrend, long black candlestick, or at support, a dragon fly Doji could signal a potential bullish reversal or bottom. After a long uptrend, long white candlestick or at resistance, the long lower shadow could foreshadow a potential bearish reversal or top.

Explanation: The market is in an overall bearish mood characterised by a downtrend. Then market opens and sells off sharply. However, the sell-off is suddenly abated and the prices reverse direction and start going up for the rest of the day closing at or near the day’s high, thus leading to the long lower shadow. The failure of the market to continue on the selling side reduces the bearish sentiment. Now the shorts are increasingly becoming uneasy with their bearish positions. If the market opens higher the next day, many shorts will have a strong incentive to cover their short positions.

Important factors:- The Bullish Dragonfly Doji pattern is a stronger bullish signal and is more reliable than a Bullish Hammer Pattern. However, a confirmation of the trend reversal implied by this pattern by either a white candlestick, a large gap up or a higher close on the next trading day is still suggested, to be on the safe side.

- Market is characterised by a downtrend.

- We see a black body formed at the lower end of the trading range.

- We then see a Doji, which does not have a lower shadow in the second day.

- No gap down is required.

Gravestone Doji: A Doji with opening and closing prices equal to the low of the day. The Bullish Gravestone Doji Pattern is a bottom reversal pattern. Similar to its cousin the Bullish Inverted Hammer Pattern, it occurs in a downtrend and represents a possible reversal of trend. The Bullish Gravestone Doji pattern forms when the open, low and close are equal and the high creates a long upper shadow. The Gravestone Doji indicates that buyers dominated trading and drove prices higher during the session. However, by the end of the session, sellers resurfaced and pushed prices back to the opening level and the session low. As with the dragon fly Doji and other candlesticks, the reversal implications of gravestone Doji depend on previous price action and future confirmation. Even though the long upper shadow indicates a failed rally, the intraday high provides evidence of some buying pressure. After a long downtrend, long black candlestick, or at support, focus turns to the evidence of buying pressure and a potential bullish reversal. After a long uptrend, long white candlestick or at resistance, focus turns to the failed rally and a potential bearish reversal.

Explanation: The market opens below the closing price of the previous day. Then there is a brief rally but the rally is not enough to send prices above the closing price of previous day and prices then reverse direction and fall down to the day’s lows. This movement, however, leaves shorts in a losing position creating the potential for an upcoming rally. It may not be clear why it signals a potential reversal. The answer has to do with what happens over the next session. If the next day opens above the real body of the Gravestone Doji, it means those who shorted at the opening (or closing) of the Gravestone day are losing money. The longer the market holds above the Gravestone Doji’s real body; the more likely these shorts will cover their positions. The shorts will then spark a rally, which also encourages the bottom pickers to go long. The Gravestone Doji pattern represents the graves of those bears or shorts that have died defending their territory.

Important factors:- The Bullish Gravestone Doji pattern requires further confirmation on the next day.

- Confirmation may be in the form of the next day opening above the Gravestone Doji’s body.

- The larger the gap the stronger the confirmation will be.

- A white candlestick with higher prices can also be another form of confirmation.

- Market is characterised by a bearish mood and downtrend.

- Then we see a Doji that gaps in the direction of the downtrend.

- The real body is either a horizontal line or it is significantly small.

- Both of the upper and lower shadows are long and they are almost equal in length.

Long-Legged Doji pattern: The Long-Legged Doji pattern is a Doji characterised with very long shadows. It shows the indecision of the buyers and sellers. It is one of the important reversal signals.

Explanation: The Long-Legged Doji pattern shows that there is a great deal of confusion and indecision in the market. This particular pattern shows that the prices moved well above and below the day's opening levels, however they finally closed virtually at the same level with the opening price. The end result is only a little change from the opening price, showing little change from the initial open, despite the whole volatility and excitement during the day that clearly reflects that the market lost its sense of direction.

Important factors:- The Long-Legged Doji pattern is more important at market tops. Long Legged Doji is a single candlestick pattern. It requires confirmation in the form of a move opposite to the prior trade on the next trading day.

- Market is characterised by a downtrend.

- We see a long black candlestick on the first day.

- Then we see a black candlestick on the second day with a gap below the first day.

- The bearish mood continues on the third and fourth days as evidenced by lower consecutive closes.

- Finally, we see a long white candlestick on the fifth day characterised by a closing price inside the gap caused by the first and second days.

Breakaway: The Bullish Breakaway pattern consists of five candlesticks. There is a downtrend but we also see that the prices bottom out and level off now. A long black day is followed by a black day that gaps below the first day. The next two days continue in the same direction with lower consecutive closes. The final day is a long white day that does not close the initial downward gap of the first and second days. This suggests a short-term reversal.

Explanation: The Bullish Breakaway pattern appears during a downtrend and it shows that selling accelerated to the point of an oversold market. In a downtrend or within a pullback of an uptrend, the share exhausts itself with a gap down, but although the downward movement continues, it slows noticeably. The long white day suggests a possible reversal in the making to at least fill the overhead gap. Declining volume on the three middle days with a pickup in volume on the white day, serves as confirmation. It starts with a long black day then involves a gap in the direction of the downtrend followed by three consecutively lower price days. So far, all days in this pattern are black with the exception of the third day, which can be either be black or white. The three days after the gap are similar to the Three Black Crows pattern since their highs and lows are each consecutively lower. It is by now apparent that the downtrend has accelerated with a big gap and then starts to fizzle, however it still continues. There is an evident slow deterioration of the downtrend suggested by this pattern. Finally, we see a burst in the opposite direction, which completely recovers the previous three days' price action. The gap is not filled which points out to the weakness of the reversal. This is a short-term reversal.

Important factors:- A confirmation on the sixth day is recommended in the form of a white candlestick, a large gap up or a higher close, to be sure about the reversal.

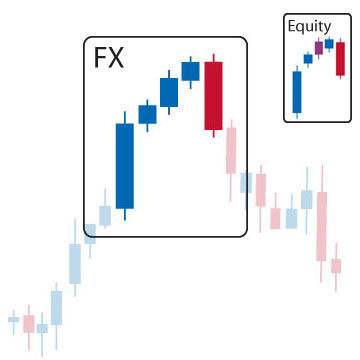

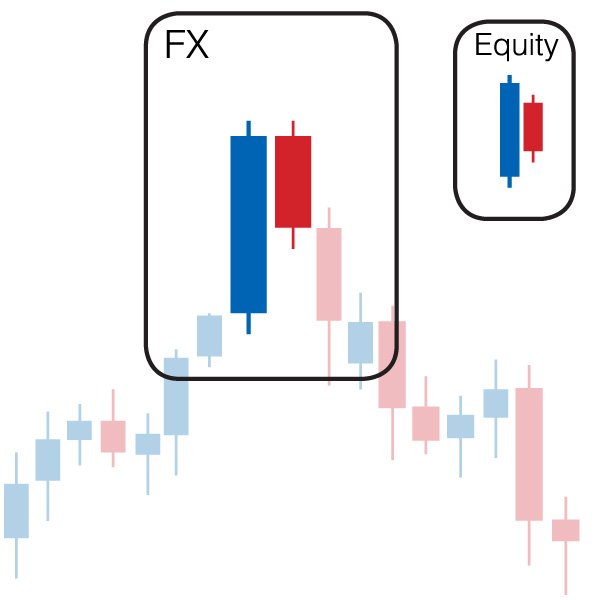

- Market is characterised by a downtrend.

- Then we see a small black body.

- The next day we see a white body that completely engulfs the black real body of the preceding day.

Bullish Engulfing pattern: The Bullish Engulfing pattern is a pattern characterised by a large white real body engulfing a preceding small black real body, which appears during a downtrend. The white body does not necessarily engulf the shadows of the black body but totally engulfs the body itself. The market should be in a definable trend, not chopping around sideways. The shadows of the prior candlestick do not need to be engulfed. The Bullish Engulfing Pattern is an important bottom reversal signal.

Explanation: While the market sentiment is bearish; we see some subsided selling reflected by the short, black real body of the first day. The next day shows bull strength with a closing price at or above the previous day’s open. It means that the downtrend is now losing momentum and the bulls are starting to take the lead.

Important factors:- The relative size of the bodies in the first and second days is important. If the first day of the Bullish Engulfing pattern is characterised by a very small real body (it may even be a Doji or nearly a Doji) but the second day is characterised by a very long real body, this strongly indicates that the bearish power is diminishing and the disparity of white versus black body is indicative of the emerging bull power.

- There is higher probability of a bullish reversal if there is heavy volume on the second real body or if the second day of the Bullish Engulfing Pattern engulfs more than one real body (which essentially means we see two or more small black bodies preceding the long white body). If not much volume occurs on the first day of the Bullish Engulfing pattern compared to the second day, then this increases the strength of the pattern. The second day opens below the close of the first day, however quickly rallies to close above the open of the first day. This damages the spirits of the shorts and brings into question the bear trend which prompts additional buying in the coming days.

- The reversal of downtrend needs further confirmation on the third day. This confirmation may be in the form of a white candlestick, a large gap up or a higher close on the third day.

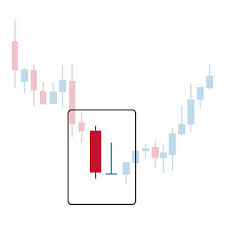

- Market is characterised by a downtrend.

- Then we see a long black candlestick.

- Long black candlestick is followed by a Doji completely engulfed by the real body of the first day. The shadows (high/low) of the Doji may not be necessarily contained within the first black body, though it is preferable if they are.

Bullish Harami Cross: The Bullish Harami Cross pattern is a Doji preceded by a long black real body. The Bullish Harami Cross pattern is a major bullish reversal pattern. It is more significant than a regular Bullish Harami pattern.

Explanation: The Bullish Harami Cross pattern is a strong signal of disparity about the market’s health. During a downtrend, the heavy selling reflected by a long, black real body; is followed by a Doji the next day. The Bullish Harami Cross pattern shows that the market is starting to severe itself from the prior downtrend. The second day's price range does not pierce the previous day's range and closes about where it opened. Volume on the second day is low which indicates that traders are lacking enough information to decide whether to go long or short.

Important factors:- The Bullish Harami pattern is not a major reversal pattern but the Bullish Harami Cross pattern is a major upside reversal pattern. Short traders will not be wise to ignore the significance of a Harami Cross just after a long black candlestick. Harami Crosses point out to the bottoms.

- A third day confirmation of the reversal is recommended (though not required) to judge that the downtrend has reversed. The confirmation may be in the form of a white candlestick, a large gap up or a higher close on the next trading day.

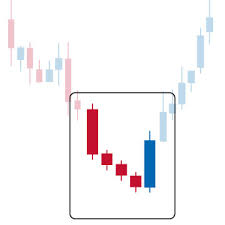

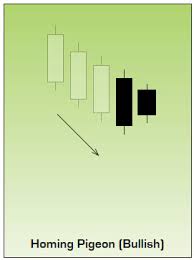

- Market is in a downtrend.

- We see a black body on the first day.

- Then we again see a black body on the second day where the real body of this second day is completely engulfed by the real body of the first day. It is not required that the shadows (high/low) of the second candlestick are contained within the first, though it is preferable if they are.

Bullish Homing Pigeon pattern: The Bullish Homing Pigeon pattern is a relatively long black real body that is followed by small black real body, which gaps opposite to the trend and is completely engulfed by the real body of the first day.

Explanation: The Bullish Homing Pigeon pattern is a signal of disparity. In a downtrend or within a pullback of an uptrend, we first see heavy selling reflected by the long, black real body of the first day. The next day’s gap up comes as a surprise to the shorts who thought they were sitting on a great position the previous day, but the share gives up some of its gap up back causing the candle to be filled in. This relaxes the bears and worries the bulls, and this is the exact recipe needed for a possible bounce. This points out to diminished power and enthusiasm of the sellers, thus suggesting a trend reversal. Confirmation is needed with a strong following day on solid volume.

Important factors:- The important fact about this pattern is the requirement that the second day has a minute real body relative to the prior candlestick and that this small body is completely contained by the larger one. The Bullish Homing Pigeon pattern is not necessarily a signal for a rally. The market usually has a tendency to enter into a congestion phase following a Homing Pigeon pattern

- The bullish Homing Pigeon pattern is similar to the Bullish Harami and the Bullish Matching Low patterns.

- We must check the third day to confirm that the downtrend has reversed. This confirmation may be in the form of a white candlestick, a large gap up or a higher close on the next trading day (on the third day).

- Market is characterised by a downtrend.

- We see three long black candlesticks characterised by consecutively lower opens and a closing sequence just like the Bearish Three Black Crows pattern.

- Then we see a black candlestick on the fourth day with an upper shadow.

- Finally we see a white candlestick opening above the body of the fourth day on the fifth day.

Bullish Ladder Bottom: The Bullish Ladder Bottom pattern consists of five candlesticks. Three black days occur with successive lower opens and lower closes. Then a black day forms with some noticeable upper shadow. The final day is a white day that gaps against the trend and opens above the body of the fourth day. The shorts may have a chance to close their positions and realize that their profits by the fourth day of a considerable downtrend. Then we see an upward gap on the fifth day as a result of this. If the body of the fifth day is long, or the volume is high, this may also imply a bullish reversal.

Explanation: In a downtrend or during a pullback within an uptrend, the bears are certainly in control and are happy. Then we see a good move downward. Prices start trading above the opening price and almost reaching to the new high of the previous day, but then they close at another new low. The buying that takes place on the fourth day that forms the long upper shadow hints at buyers starting to bottom fish. This action is a warning for the shorts telling them that the market will not go down forever and the shorts may then be forced to reevaluate their positions and they start closing their positions on the next day if profits are good. The intraday sell-off that closes the share at the lows likely wipes out the bulls, and with the lack of sellers available, there is not much resistance left when the shorts start to cover. This act is the reason behind the upward gap we see on the last day of the pattern and also the close is considerably higher. If volume is high on the last day, a trend reversal has probably occurred.

Important factors:- The Bullish Ladder Bottom pattern is similar to the Bullish Concealing Baby Swallow pattern and the Bearish Three Black Crows pattern.

- A confirmation on the sixth day is suggested in the form a white candlestick, a large gap up or a higher close, to be sure that the market has reversed.

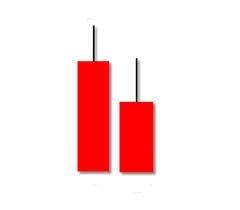

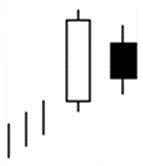

- The market moves in a downtrend.

- We then see a long black candlestick on the first day.

- Second day follows with another black candlestick whose closing price is equal or extremely close to the closing price of the first day.

Bullish Matching Low: The Bullish Matching Low pattern occurs when two black days appear with equal closes in a downtrend. The pattern is suggestive of a short-term support, and it may cause a reversal on the next day of trading.

Explanation:

The market continues to move lower, signaling that the bears are in control, as evidenced by the first black candlestick. The next day prices open at a higher level

by gapping up, they then continue to go up during the day but closes at the same level as the previous day. This pattern suggests a short-term support level.

The more times a share can successfully test and hold a low or support level, the higher the chance a reversal will occur once the sellers become exhausted.

Shorts should be aware of this fact. If they ignore the Bullish Matching Low pattern as a possible reversal signal, they may pay for it soon.

Two days closing at the same price is indicative of short-term support and this support may be followed by a reversal on the next day of trading.

Strength the following day with volume would confirm the pattern.

- The bullish Matching Low pattern is similar to the Bullish Homing Pigeon pattern.

- The reversal of downtrend requires a confirmation on the third day.

- The confirmation of the trend reversal may be in the form of a white candlestick, a large gap up or a higher close on the next trading day (on the third day).

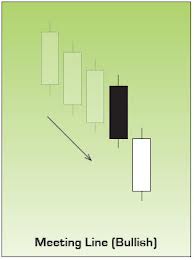

- Market is characterized by a downtrend.

- We see a black candlestick on the first day.

- Then we see a long white candlestick on the second day. Its body is lower than the previous trend.

- The closing prices are same or almost same on both days.

- Both candlesticks are long but the second candlestick may be shorter than the first.

Bullish Meeting Lines: The Bullish Meeting Lines pattern is a pattern that reflects a stalemate between the bulls and the bears. A long black day is followed by a long white day that gaps sharply lower when it opens in the direction of the trend but then rallies to close at the same price as the black day’s close.

Explanation: In a downtrend or during a pullback within an uptrend, a long black day occurs. The next day gaps down in the direction of the trend, causing the bears to feel confident and most likely the remaining bulls to throw in the towel. The share then rallies as bottom fishers step in or as the bulls start a counterattack pushing the prices up and the shorts to start covering their positions. The identical close of the two candles can be considered to be incidental and not extremely important. The fact remains that the bulls were washed out and now short covering may cause the share price to bounce as the downtrend has now been breached.

Important factors:- The Bullish Meeting Lines pattern is similar to the Bullish Piercing Line pattern, the Bearish In Neck pattern, the Bearish On Neck pattern, and the Bearish Thrusting pattern.

- The Bullish Meeting Lines pattern is a pattern that is comparable to the Bullish Piercing Line pattern. The Piercing Line pattern has the same two-candlestick pattern. The main difference between the two is the fact that the bullish counterattack does not carry the prices up to the prior session’s white real body in the case of the Bullish Meeting Lines pattern. It can only get back to prior session’s close while the Piercing Line pattern’s second line pushes well into the black real body. Consequently the Piercing Line pattern is a more significant bottom reversal pattern. Nonetheless, the Bullish Meeting Lines pattern should also be respected.

- The Bullish Meeting Lines pattern requires confirmation of the reversal on the third day. This confirmation may be in the form of a white candlestick, a large gap up or a higher close on the third day.

- Market is characterized by downtrend.

- We see a Black Closing Marubozu on the first day.

- Then we see a white candlestick, which is above the close of the first day.

- Then we again see a Black Closing Marubozu characterised with a close equal to the close of the first day.

Bullish Stick Sandwich: The Bullish Stick Sandwich pattern is characterised by a black day that is followed by a white day that gaps against the downtrend and closes above the black day’s high. The third day is a black day whose close is equivalent to that of the first day. The pattern shows consecutive higher opens for three days, but results in an eventual close equal to the first day's close. It may warn that prices are now finding a support level. We may then see a reversal from this support level.

Explanation: In the Bullish Stick Sandwich pattern, there is a downtrend going on. Then prices open higher on the next trading day and they reach to higher levels all day, closing at or near the high. This bullish act suggests that the previous downtrend may now reverse implying that the shorts need protection. The next day, prices open at a higher level leading some shorts to cover their positions initially but then the prices start moving lower to close at the same price as two days ago. After two consecutive higher opens, the share price is right back where it started. One can sense that the share wants to move up, but it needs to solidify support first. As long as the support level holds a reversal is possible.

Important factors:- A confirmation on the fourth day is required to be sure that the downtrend is reversed. Confirmation may be in the form of a white candlestick, a large gap up or a higher close on the fourth day.

- Market is characterized by a downtrend.

- We see a long Black Opening Marubozu pattern on the first day characterized by a long lower shadow just like a Hammer pattern.

- We then see a Black Opening Marubozu pattern on the second day similar to the first day, however, smaller in body with a low above the first day’s low.

- We finally see a small Black Marubozu pattern on the third day that lies within the second day’s trading range.

Bullish Three Stars in the South: The Bullish Three Stars in the South pattern consists of three consecutive black candlesticks during a downtrend. A long black day with a long lower shadow is followed by a similar but smaller black day whose lower shadow is shallower than the first day. The third day is a small Black Marubozu pattern (i.e. the open is the high of the day and the close is the low of the day) that lies within the second days trading range.

Explanation: The Bullish Three Stars in the South pattern is a bottoming pattern that shows a slowly deteriorating downtrend, which is characterised by each of the successive black candles slightly less bearish than the previous one, so the trend is slowly weakening. Buying enthusiasm is reflected by the long lower shadow of the first day. The next day opens at a higher level, trades lower, but its low is not lower than the previous day's low. This second day also closes off its low. Then we see a black Marubozu pattern, which is engulfed by the previous day's range on the third day. Higher lows cause uneasiness among the shorts. The last day of the pattern reflects market indecision, with hardly any price movement. The shorts are now ready to cover their positions if they see anything on the upside. Everything points out that the tide is slowly turning toward the bullish side. As long as the low of the first candle is held, and a white candle on volume can form soon after, a reversal may be in the works.

Important factors:- The Bullish Three Stars in the South pattern is similar to the Bearish Three Black Crows pattern

- A confirmation on fourth day is required to be sure that the downtrend has reversed. This confirmation may be in the form of a white candlestick, a large gap up or a higher close on the fourth day.

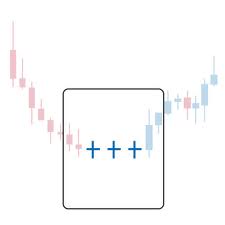

- Market is characterised by a downtrend.

- Then we see three consecutive Doji.

- The second day Doji gaps below the first and third.

Bullish Tri Star: The Bullish Tri Star pattern is a very rare but significant bottom reversal pattern. Dojis occur on three consecutive trading days with the second being a Doji Star that gaps lower and the third Doji gapping back up.

Explanation: In a downtrend or during a pullback within an uptrend, a battle begins. In the case of a Bullish Tri Star Pattern, we have a market that has been in a downtrend for a long time. The bears start to back off while the bulls step up. The weakening trend shows itself by the fact that the real bodies are probably becoming smaller. Dojis indicate an even battle between the bulls and bears. The formation of three Dojis within a downtrend hints that the bulls may be starting to reassert themselves. The first Doji is a matter of concern. The second Doji clearly indicates that market is losing its direction, while the third Doji warns that the downtrend is over. This pattern indicates too much indecision leading to a reversal of positions. A white day with volume is needed to confirm the reversal.

Important factors:- A confirmation on fourth day is required to be sure that the downtrend has reversed.

- Confirmation may be in the form of a white candlestick, a large gap up or a higher close on the fourth day.

- Market is characterized by a downtrend.

- We see a long black candlestick on the first day.

- Then we see a Hammer-like black candlestick on the second day.

- The lower shadow of the second day sets a new low.

- Then we see a short white candlestick, which is below the second day’s candlestick.

Unique Three River Bottom pattern: The Bullish Unique Three River Bottom pattern is an extremely rare bottom reversal pattern. Its first candlestick is an extended black candlestick followed by a Homing Pigeon pattern (a black real body closing higher than the first candlestick’s close) whose lower shadow makes a new low, and the third candlestick is a white candlestick with a very small real body that closes below the second day’s close.

Explanation: In a downtrend or during a pullback within an uptrend, a black day occurs. The next day opens at a higher level, however, bearish sentiment is strong causing a new low during the day. The day closes near the high, thus producing a small black body within the body of the first day. This second black day has a long lower black shadow which indicates the possibility of an intraday washout of the bulls. This rally questions the strength of bears. The increasing uncertainty is further strengthened when the third day opens lower but not as low as the low of the second day. There is some stability on the third day as evidenced by its small white body. Since the third day gaps lower, the bears are still thought to be somewhat in control, but the higher close (inability of the bears to push the share lower) suggests the bearish tone may be changing. The third day ends by a rally closing below the close of the second day. If price rises to new high on the fourth day, then a reversal of trend is confirmed.

Important factors:- A confirmation on fourth day is advisable to show that the downtrend has reversed. This may be in the form of a white candlestick, a large gap up or a higher close on the fourth day.

Belt Hold

Hammer

Harami

Inverted Hammer

- There must be an overall downtrend in the market.

- The day gaps down, and the market opens at its low but then prices go up during the day and they close near to the days high.

- We see a white body that has no lower shadow that is a White Opening Marubozu.

Bullish Belt Hold: The Bullish Belt Hold pattern is also single candlestick pattern. It is basically a White Opening Marubozu that occurs in a downtrend. As such; it opens on its low, then we see a rally during the day against the overall trend of the market, and then the day closes near its high but not necessarily at its high. If Belt Hold lines are characterized by longer bodies, then it means that they offer more resistance to the trend they are countering.

Explanation: The market starts the day with a significant gap in the direction of prevailing downtrend. So the first impression reflected in the opening price is continuation of the downtrend. The remaining price action for the day occurs to the upside. This triggers a buying spree. However; then things change rapidly and the price action of the day is the opposite to the previous trend. This obviously causes much concern among some shorts, which cover their positions due to concern over this price action. This accentuates the reversal and it may signify a rally for the bulls.

- The market is characterised by a prevailing downtrend.

- Then we see a small real body at the upper end of the trading range. Colour of this body is not important.

- We would like to see the lower shadow at least twice as long as the real body.

- There is no (or almost no) upper shadow.

Bullish Hammer: The Bullish Hammer pattern is a significant candlestick that occurs at the bottom of a trend or during a downtrend and it is called a hammer since it is hammering out a bottom. The Bullish Hammer pattern is a single candlestick pattern and it has a strong similarity to the Bullish Dragonfly Doji pattern. In the case of Bullish Dragonfly Doji pattern, the opening and closing prices are identical, whereas the Bullish Hammer pattern has a small real body at the upper end of the trading range.

Explanation: The overall direction of the market is bearish, characterised by a downtrend. Then the market opens with a sharp sell-off implying the continuation of the downtrend. However, prices suddenly turn upwards, the sell-off is quickly abated and bullish sentiment continues during the day with a closing price at or near to its high for the day which causes the long lower shadow. Apparently the market fails to continue in the selling side. This observation reduces the previous bearish sentiment causing the short traders to feel increasingly uneasier with their bearish positions. As with any single candlestick pattern, confirmation is required. The Bullish Hammer pattern shows that the price goes much lower than the open then closes near the opening price. This fact reduces the confidence of the bears. Ideally, a white real body Hammer with a higher open the following day could be a bullish signal for the days ahead.

Important factors:- If the Hammer is characterised by a close above the open, thus causing a white body, the situation looks even better for the bulls.

- The Bullish Dragonfly Doji pattern is generally considered more bullish than the Bullish Hammer pattern and a higher reliability is ascribed to this Doji than the Bullish Hammer pattern.

- The reliability of Bullish Hammer pattern is low. It requires confirmation of the implied trend reversal by a white candlestick, a large gap up or a higher close on the next trading day.

- The market is in a bearish mood characterized by a downtrend.

- Then we see a long black candlestick.

- We see a white candlestick on the following day where the small white real body is completely engulfed by the real body of the first day. The shadows (high/low) of the second candlestick are not necessarily contained within the first body, however, it is preferable if they are.

Bullish Harami pattern: The Bullish Harami pattern is characterised by a small white real body contained within a prior relatively long black real body. Harami is an old Japanese word for pregnant. The long black candlestick is the mother and the small candlestick is -the baby-.

Explanation: The Bullish Harami pattern is a sign of disparity about the market’s health. A long first day with high volume in the existing downtrend brings complacency to the bears. While the market is characterised by downtrend and bearish mood; there is heavy selling reflected by a long, black real body. However, this is followed by a small white body in the next day as the next day trades in a small range within the previous day's real body. This may signal a trend reversal since the second day’s small real body shows that the bearish power is diminishing. Light volume on the second day should give rise to concern by the bears of an impending change of trend. Look for higher prices over the coming days, especially if the next day provides confirmation of a trend change by closing higher.

Important factors:- The decisive fact about this pattern is that the second candlestick has a minute real body relative to the prior candlestick. Furthermore this small body is completely inside the larger one. The Bullish Harami Pattern does not necessarily imply that a rally will follow. Market usually enters into a congestion phase following the Bullish Harami.

- We may need a third day confirmation to be sure that the downtrend has really reversed. This confirmation of the trend reversal may be signaled by a white candlestick, a large gap up or by a higher close on the third day.

- Market is currently characterised by a downtrend.

- The first day of the pattern is a black candlestick formed at the lower end of the trading range.

- The second day of the pattern is a small real body and is formed at the lower end of the trading range.

- The colour of the second real body is not important, however the colour of the body is black in the first day.

- No gap down is required, as long as the pattern is seen after a downtrend.

- Upper shadow of the second small body should be at least twice as long as the real body.

- The second body does not have lower shadow or it has only a very little lower shadow.

Bullish Inverted Hammer: The Bullish Inverted Hammer pattern is a candlestick characterised by a long upper shadow and a small real body preceded by a long black real body. It is similar in shape to the Bearish Shooting Star. The shooting star appears in a downtrend and thus it becomes a potentially bullish inverted hammer.

Explanation: The Bullish Inverted Hammer pattern occurs in a bearish background. In a day of inverted hammer, market opens at or near its low. Then prices change direction and we see a rally. However the bulls cannot succeed to sustain the rally during the rest of the day and prices finally close either at or near the low of the day. It may not be clear why this type of price action is interpreted as a potential reversal signal. The answer has to do with what happens over the next day. If the next day opens above the real body of the inverted hammer, it means that those who shorted at the opening or closing of the inverted hammer day are losing money. The long upper shadow and small real body at the bottom of the trading range are cause for concern for the bears. They wonder if this is the end of the downtrend and take measures to protect their gains. If the next day opens above the body of the Inverted Hammer, then expectations could be for shorts to cover and propel a reversal rally. The longer the market holds above the inverted hammer’s real body, the more likely these shorts will attempt to cover their positions. This may ignite a rally as a result of covered short positions, which may then inspire the bottom pickers to take long positions.

Important factors:- Bullish verification on the day following the inverted hammer is required. This verification can be in the form of the next day opening above the inverted hammer’s real body. The larger the gap the stronger the confirmation will be. A white candlestick with higher prices can also be another form of confirmation.

Mat hold pattern

Rising three methods

Side-by-side white lines

- Market is characterised by an uptrend.

- We see a long white candlestick in the first day.

- We then see an upward gap and a black candlestick on the second day.

- We see a sequence of small real bodies constituting a brief downtrend but it stays within the range of the first day on the second, third, and fourth days.

- Finally we see a white candlestick, which opens with a gap and closes with a new high on the fifth day. The fifth day simply continues the trend.

Bullish Mat Hold pattern: The Bullish Mat Hold pattern is known as a strong continuation pattern. In this pattern, a long white candlestick appears during an uptrend, which then is followed by three consecutive small real bodies that constitute a short downtrend. Then bull ascendancy begins on the fifth day marked with a closing price that is a new high.

Explanation: The pattern appears during an uptrend, which is further confirmed by the first long white candlestick. Prices open with a gap the next day and they trade within a narrow range, closing at a slightly lower level, briefly pulling back (preferably on light volume). This may be a lower close but it is still a new closing high along the uptrend. This suggests that the bulls now prefer to rest while the bears are encouraged. The next couple of days start causing some concern about the ability of the upward move to sustain itself since these days open at the level where the market closed on the previous day and they close at slightly lower levels. In any case, the markets are still higher than the opening price of the first day even on the third day, and remember that the first day was a long white candlestick day. This observation shows that there was an attempt for reversal but it failed. Prices rise again to close at a new closing high apparently showing that the events of past few days were only a pause in a strong upward trend. The fifth day simply continues the trend. It appears that attempts to reverse the trend occurred, but failed. The upward trend should continue. The brief pullback was nothing more than a few days off for the bulls.

Important factors:- he Bullish Mat Hold pattern is similar to the Bullish Rising Three Methods pattern. The difference is that the reaction days, two, three, and four are altogether higher than those in the Bullish Rising Three Methods Pattern.

- The reliability of this pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

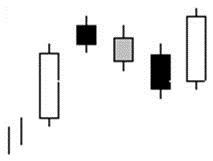

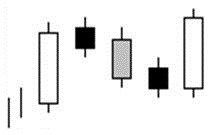

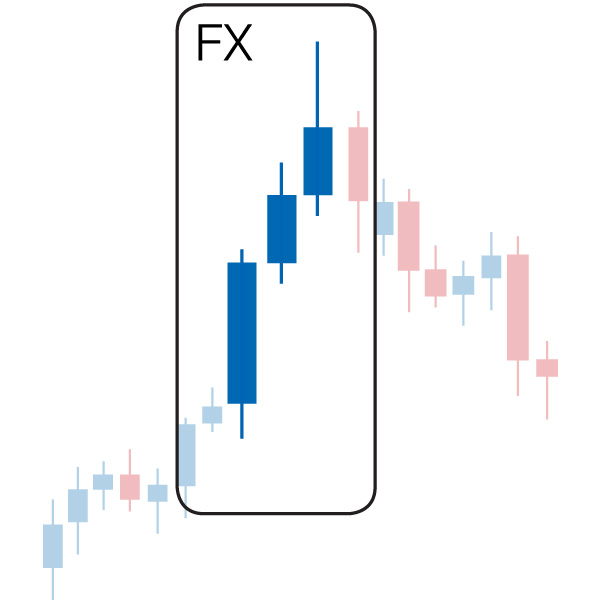

- Market is characterised by an uptrend.

- We see a long white candlestick on the first day.

- Then we see small real bodies defining a brief downtrend but staying within the range of the first day on the second, third and fourth days.

- Finally we see a long white candlestick on the fifth day opening above the close of the previous day and also closing at a new high. The fifth day simply continues the trend.

Rising Three Methods pattern: The Bullish Rising Three Methods pattern is a bullish continuation pattern representing a pause during a trend without causing a reversal. The Bullish Rising Three Methods is similar to the bullish Mat Hold pattern. The pattern is characterised by a long white candlestick followed by three small bodies in three consecutive days. The small bodies represent some resistance to previous uptrend and they may even trace a short downtrend. These three reaction days usually have black candlesticks but the bodies remain within the high and low range of the first day's white candlestick. The pattern is completed by a white candlestick on the fifth day, opening above the close of the previous day and closing at a new high. The small downtrend between the two long white candlesticks represents a break during the uptrend. The upward trend then resumes and continues.

Explanation: The Bullish Rising Three Methods pattern typically represents a rest in the market action, or a brief pullback (preferably on light volume). This may be used to add new positions by longs. The pattern is the reflection of doubts about the ability of the trend to continue. This doubt may increase because of small-range reaction days. However, given the fact that a new low cannot be made, the bullishness is resumed and new highs are set quickly. The brief pullback is nothing more than a few days off for the bulls.

Important factors:- The high-low range includes the shadows.

- The reliability of the Bullish Rising Three Methods pattern is very high, but a confirmation in the form of a white candlestick with a higher close or a gap-up still is suggested. Remember, that these particular candlestick patterns are rare.

- Market is characterised by an uptrend.

- We see a white candlestick in the first day.

- Then we see another white candlestick on the second day with an upward gap.

- Finally, we see a white candlestick on the third day characterised by the same body length and whose closing price is equal to the close of the second day and a new high is established.

Side-By-Side White Lines pattern: The Bullish Side-By-Side White Lines pattern consists of three candlesticks. A white candlestick with an upward gap over another white candlestick is followed in the next day by another similar sized white candlestick. The second and the third days have the same opening price.

Explanation: The Bullish Side By Side White Lines pattern appears in a bullish market. The first white candlestick confirms the continuation of the bull market. In an uptrend the second white candle that gaps up could signify the last of the bulls getting in “at any price.” On the second day, the market opens with an upward gap and it closes at a still higher level. The gap down the next day could be the start of a pullback, but since the share rallies again, the bulls obviously are not done yet. On the third day, the market suddenly opens at a much lower level even as low as the previous day's open. However, the initial selling that causes the lower opening ends quickly and the market again climbs to yet another high. As a continuation pattern, this formation hints at more upside to come and demonstrates that the bullish move is continuing.

Important factors:- The two side-by-side white candlesticks that we see after the upward gap are not only of similar size, but also their opening prices should be almost the same.

- The reliability of the Bullish Side By Side White Lines pattern is very high, but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested.

Upside Gap 3 Methods

Upside Tasuki Gap

- Market is characterised by an uptrend.

- We see two long white candlesticks with a gap between them.

- Then we see the black candlestick on the third day, which opens within the body of the second day.

- The third black candlestick fills the gap between the first two days.

Bullish Upside Gap Three Methods: The Bullish Upside Gap Three Methods pattern is characterized by two long white candlesticks with a gap upward between them during an uptrend. The third day is a black candlestick, which closes the gap between the first two. A support for uptrend may be forming caused by temporary profit taking.

Explanation: With the Bullish Upside Gap Three Methods pattern, the market is in a strong bullish mood. The bullish move goes on further by another day that gaps in the direction of the uptrend. However, the third day opens well into the body of the second day filling the gap. The gap-closing move may be interpreted as supporting the current uptrend. Gaps create excellent support and/or resistance points, which become evident after a reasonable period of time. The gap here is filled within one day suggesting other considerations. If this is the first gap of a move, then the third day action, also called reaction day, can be considered as profit taking. It is usually defined as a closing gap movement in technical analysis. As long as the white candles have higher volume than the black, the one black profit taking day should not be a big concern. The uptrend should continue if indeed the share is strong.

Important factors:- This Bullish Upside Gap Three Methods pattern is a simple pattern similar to the Bullish Upside Tasuki Gap pattern (discussed next). However, the Bullish Upside Tasuki Gap pattern is characterised by a gap in the first two days and it is not filled on the third day.

- A confirmation on fourth day is required in the form of a white candlestick, a large gap up or higher close.

- Market is characterised by an uptrend.

- We see two long white candlesticks with a gap between them.

- Then we see black candlestick on the third day that opens within the body of the second day.

- The third day candlestick closes into the gap but does not fully close the gap.

Bullish Upside Tasuki Gap: The Bullish Upside Tasuki Gap pattern is characterised by two long white candlesticks with a gap upward between them during an uptrend. However, the pattern also shows a black candlestick on the third day partially closing the gap between the first two. The black candlestick is the result of temporary profit taking. We expect the trend to continue upward following the direction of the upward gap.

Explanation: The Bullish Upside Tasuki Gap pattern appears in a strongly upward market. This bullish move continues one more day with a gap in the direction of the uptrend. The black candlestick of the third day is characterized by an opening well into the body of the second day, which partially fills the gap. This third day, called the correction day, do not completely fill the gap so the previous uptrend should continue. This is a case of temporary profit taking. Since the gap a gap is partially filled, this is simply a profit taking scenario. We have a strong share in an uptrend that pulls back. As long as the black day is on lighter volume, the bulls will most likely retake control soon after and the previous upward trend must continue.

Important factors:- This Bullish Upside Tasuki Gap pattern is a rare formation.

- The real bodies of the last two candlesticks in the Bullish Upside Tasuki Gap pattern are about the same size.

- This Bullish Upside Tasuki Gap pattern is a simple pattern quite similar to the Bullish Upside Gap Three Methods pattern. The only difference is that in the Bullish Upside Gap Three Methods pattern, the gap that is made between the first two days is filled on the third day.

- A confirmation on the fourth day is recommended in the form of a white candlestick, a large gap up or a higher close.

Separating Lines

Bullish 3 Line Strike

- Market is characterised by an uptrend.

- We see a long black candlestick in the first day.

- Then we see that the second day has the same opening price as the first day, or extremely close to it.

- &The second day pattern is a White Opening Marubozu.

Separating Lines: The Separating Lines pattern is simply a black day followed by a white day (White Opening Marubozu) that has the same opening price. During an uptrend, after we see a black candlestick in the first day, the market gaps up sharply higher when it opens with an opening price equal to the prior session’s opening and it also closes the day at a higher level.

Explanation: In an uptrend, the underlying issue gaps up and falls to produce a black real body (especially a relatively long one), which is a matter of concern for longs as it may indicate that the bears may be gaining control. However, if the next day opens with a gap such that the second day opening price is equal to the previous black day’s opening price, it shows that the bears lost control of the market. If this white candlestick also closes at a higher level, it tells us the bulls have regained control and the uptrend will continue. This proves to be simple profit taking within the uptrend when the issue gaps up the next day and rallies to close near its high. In an uptrend, the Bullish Separating Lines pattern has low reliability, while the pattern is similar to the Bullish Kicking pattern.

Important factors:- The second pattern must be a White Opening Marubozu.

- A third day confirmation is required to be sure that the rally continues. This confirmation may be in the form of a white candlestick, a large gap up or a higher close on the next trading day (on the third day).

- Market is characterised by an uptrend.

- We see three consecutive long white candlesticks with consecutively higher closes.

- Then we see a black candlestick opening at a higher level and closing below the open of the pattern’s first day.

Bullish Three Line Strike: The Bullish Three Line Strike pattern is formed by three white long candlesticks with consecutively higher closes followed by a black candlestick on the fourth day that drives prices back to the point where they were at the beginning of the pattern. In an uptrend the Three Line Strike pattern has low reliability. The large black day can really scare the bulls and many contrarians will cite this as bullish. If indeed the uptrend was in a strong bullish trend before the pattern, then the one black day should not ruin the pattern. Hence, if the next day is up, the uptrend should continue higher. The Bullish Three Line Strike pattern is a possible continuation of the bullish Three White Soldiers pattern.

Explanation: The Bullish Three Line Strike pattern appears in a market characteristically in uptrend as evident in the three white candlesticks. The fourth day opens in the direction of the trend, however it then moves in opposite direction due to profit taking. There may be a reevaluation of the market direction now. However, we know that this move completely eradicated the gains of the previous three days. If the previous trend was really strong, this may now be interpreted as a temporary setback caused by profit taking. The last day of the pattern shows liquidating which may now give the upward trend a new strength to continue in the previous upward direction.

Important factors:- A confirmation on the fifth day in the form a white candlestick, a large gap up or a higher close is definitely required.

Abandoned baby

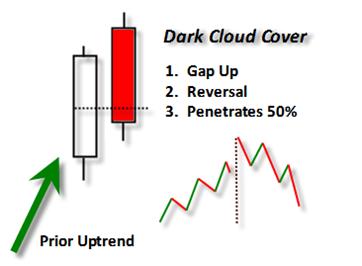

Dark Cloud Cover

Evening Doji Star

Evening Star

Reversal Kicking

3 Black Crows

3 Inside-Down

3 Outside-Down

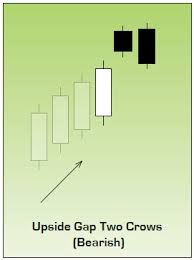

Upside Gap 2 Crows

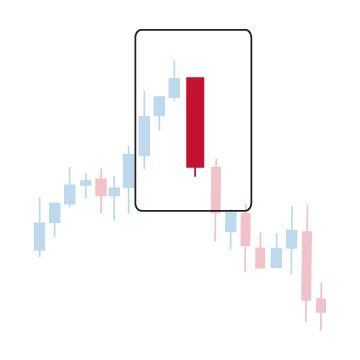

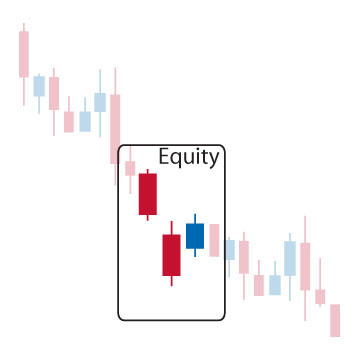

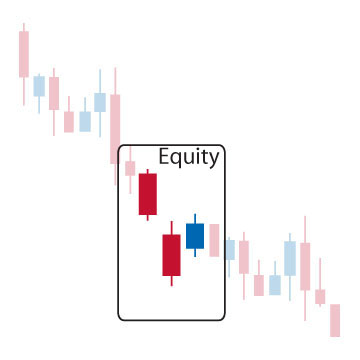

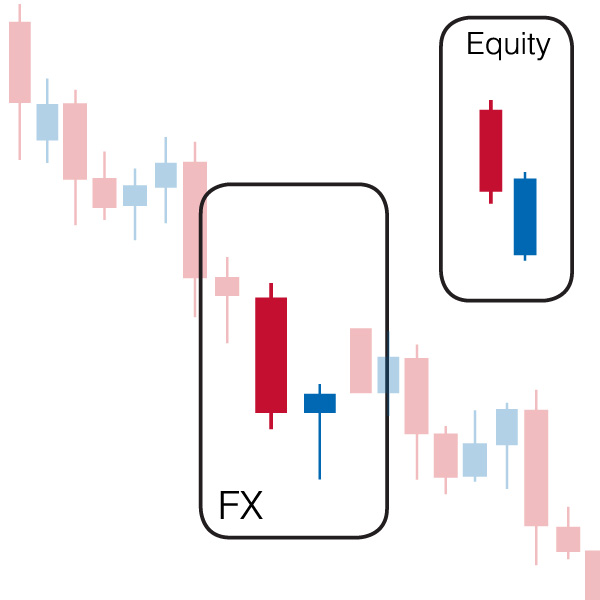

- Market is characterised by an uptrend.

- It is basically a long white day followed by a Doji that gaps in the direction

- Then we see a Doji on the second day whose shadows characteristically gap above the previous day's upper shadow and also gaps in the direction of the previous uptrend.

- Finally we see a black candlestick characterised with a gap in the opposite direction, with no overlapping shadows.

Bearish Abandoned Baby: The Bearish Abandoned Baby pattern is a very rare top reversal signal. It is basically a long white day followed by a Doji that gaps in the direction of the trend. Then a black day occurs gapping in the opposite direction with no overlapping shadows.

Explanation: Most of the three-day star patterns have similar scenarios. In an uptrend or within a bounce of a downtrend, the market seems still strong displaying a long white candlestick and opening with a gap on the second day but does not continue with it's upward movement. The trading on second day is within a small range and its closing price is equal or very near to its opening price. Now there is a sign of sell-off potential with reversal of positions with enough bears stepping in to bring supply and demand back into equilibrium and the share price churns in place. This is not necessarily bearish, but it is certainly less bullish. The trend reversal is confirmed by the black candlestick on the third day. A downward gap also supports the reversal.

Important factors:- The Bearish Abandoned Baby pattern does not occur too often and is similar to the Bearish Doji Star, Bearish Evening Star, and Bearish Evening Doji Star.

- The reliability of the Bearish Abandoned Baby pattern is very high,but still a confirmation in the form of a black candlestick with a lower close or a gap-down is suggested.

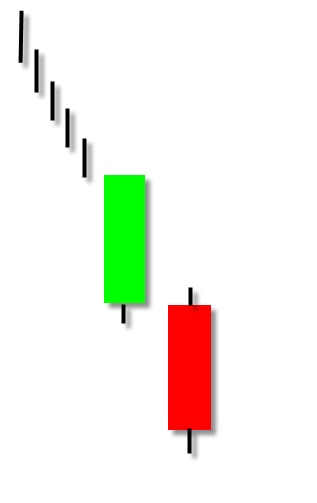

- Market is characterized by an uptrend.

- We see a long white candlestick in the first day.

- Then we see a black body characterized by an open above the high of the previous day on the second day.

- The second black candlestick closes within and below the midpoint of the previous white body.

Bearish Dark Cloud Cover: The Bearish Dark Cloud Cover pattern is a two-candlestick pattern signaling a top reversal after an uptrend or, at times, at the top of a congestion band. We see a strong white real body in the first day. The second day opens strongly above the previous day high (it is above the top of the upper shadow). However, market closes near the low of the day and well within the prior day’s white body at the end of the day.

Explanation: In an uptrend or within a bounce of a downtrend, we see a strong white candlestick suggesting that bulls retain the control. However, the rally does not continue as this is followed by a gap as we encounter sellers who push the share price back down. The market suddenly closes at or near the lows of the day so the second day body moving well into the prior day’s real body. This simply signifies the possibility of a reversal that is more reliable if the gap up occurs at resistance and the black day is accompanied by a surge in volume. Longs are shaken somehow and short sellers now have a benchmark to place a stop, which is at the new high of the second day.

Important factors:- If the black real body’s close penetrates deeper into the prior white real body, the chance for a top increases. Some Japanese technicians require more than a 50% penetration of the black day’s close into the white real body.

- If the black candlestick does not close below the halfway point of the white candlestick then it is better to wait for confirmation following the dark cloud cover; and even if it does, a confirmation may still be necessary. This confirmation may be in the form of a black candlestick, a large gap down or a lower close on the next trading day.

- Market is characterized by uptrend.

- We see a white candlestick in the first day.

- Then we see a Doji that gaps in the direction of the previous uptrend on the second day.

- Finally the third day is a black candlestick.

Bearish Evening Doji Star: The Bearish Evening Doji Star pattern is a major top reversal pattern formed by three candlesticks. The first candlestick is a long white body; the second is a Doji characterized by a higher gap thus forming a Doji star. The third one is a black candlestick with a closing price, which is within the first day’s white real body. It is a meaningful top pattern.

Explanation: The first white body, while the market is in an uptrend, shows the continuing bullish nature of the market. Then a Doji appears showing the diminishing power of the longs. The strong black real body on the third day proves that bears have taken over. An ideal Bearish Evening Doji Star pattern has a gap before and after the middle real body. The second gap is rare, but lack of it does not take away from the power of this formation.

Important factors:- The Doji may be more than one, two or even three.

- Doji’s gaps are not important.

- The Bearish Evening Doji Star is similar to the Bearish Doji Star, Bearish Evening Star, and Bearish Abandoned Baby patterns.

- The reliability of this pattern is very high, but still a confirmation in the form of a black candlestick with a lower close or a gap-down is suggested.

- Market is characterised by an uptrend.

- We see a long white candlestick in the first day. Then we see a small candlestick on the second day with a gap in the direction of the previous uptrend.

- Finally we see a black candlestick on the third day.

Bearish Evening Star:

The Bearish Evening Star pattern is a major top reversal pattern formed by

three candlesticks. The first candlestick is a long white body;

the second one is a small real body that may be white.

It is characteristically marked with a gap in higher direction thus forming a star.

In fact, the first two candlesticks form a basic star pattern.

Finally we see the black candlestick with a closing price well within the first session’s

white real body. This pattern clearly shows that the market has now turned bearish.

A candlestick that gaps away from the previous candlestick is said to be in star position. A Star appears when a small body gaps ABOVE the previous day's long body.

Stars are part of more complicated candlestick patterns,

especially the reversal patterns.

Explanation: The market is already in an uptrend when the white body appears which further suggests the bullish nature of the market. Then a small body appears showing the diminishing capacity of the longs. The strong black real body of the third day is a proof that the bears have taken over. An ideal Bearish Evening Star Pattern has a gap before and after the middle real body. The second gap is rare, but lack of it does not take away from the power of this formation.

Important factors:- The stars may be more than one, two or even three.

- The colour of the star and its gaps are not important.

- The Bearish Evening Star is similar to the Bearish Evening Doji Star, Bearish Abandoned Baby, Bearish Doji Star, Bearish Two Crows, and Bearish Upside Gap Two Crows patterns.

- The reliability of this pattern is very high, but still a confirmation in the form of a black candlestick with a lower close or a gap-down is suggested.

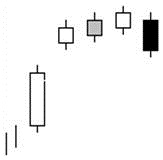

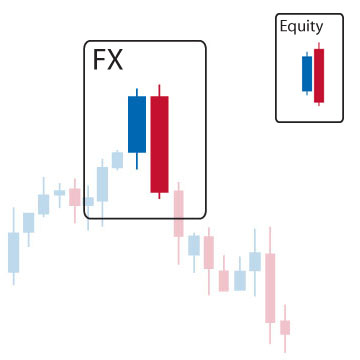

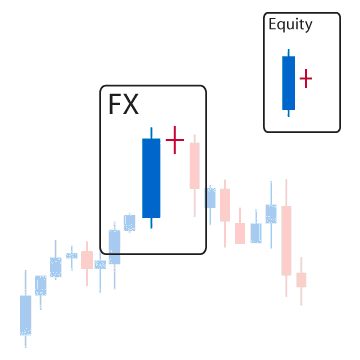

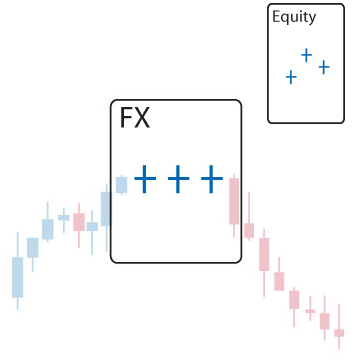

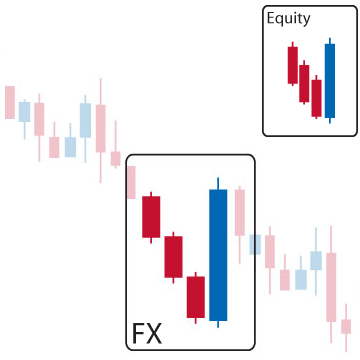

- Market direction is not important.

- We see a White Marubozu in the first day.

- Then we see Black Marubozu day that gaps downward on the second day.

Bearish Reversal Kicking: The Bearish Reversal Kicking pattern is a White Marubozu followed by a sharply lower gap when it opens during the second day. The second day opening is even below the prior session’s opening (forming a Black Marubozu). A big black candle that opens at its high and closes at the day's low is bearish regardless of the overall trend. Volume confirmation on the black day solidifies the pattern as is a follow up weak day. The Bearish Reversal Kicking pattern is similar to the Bearish Separating Lines pattern.

Explanation: The Bearish Kicking pattern sends a strong signal suggesting that the market is now heading downward. The previous market direction is not important in this pattern unlike most other candlestick patterns. The market has been in a trend when prices gap down the next day in the case of Bearish Kicking Pattern. The prices on the second day never enter into the previous day's range and we have a close with another gap.

Important factors:- Both of the candlesticks do not have shadows (or very small shadows if any). In other words both are Marubozu.

- The Bearish Kicking pattern is similar to the Bearish Separating Lines pattern except that instead of the open prices being equal, in the Bearish Kicking pattern a gap occurs.

- The Bearish Kicking pattern is highly reliable but still a confirmation may be necessary, and this confirmation may be in the form of a black candlestick, a large gap down or a lower close on the next trading day.

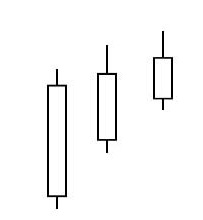

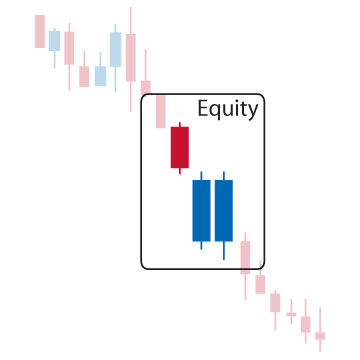

- Market is characterised by an uptrend.

- Three consecutive long black candlesticks appear.

- Each day closes at a new low.

- Each day opens within the body of the previous day.

- Each day closes near or at its lows.

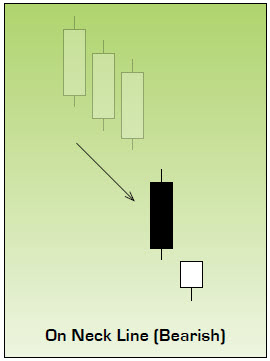

Bearish Three Black Crows: The Bearish Three Black Crows pattern is indicative of a strong reversal during an uptrend or within a bounce of a downtrend, the three long black candles speak for themselves. It consists of three long black candlesticks, which look like a stair stepping downward. If volume accompanies the move, the reliability of the pattern increases significantly. The opening price of each day is higher than the previous day's closing price suggesting a move to a new short term low.